Are you aware of the debt collection guidelines in Australia? Do you know there is an acceptable, mature, and most of all legal way of trying to recover debt?

Debts can accumulate over time when one isn’t careful about money management. Whether you’re a debtor or creditor, debts can be a hindrance when it comes to long term savings for things such as retirement.

Debt, People, and Businesses

Debts seem to be a part of everyday life. With the convenience of using credit cards and taking advantage of payment schemes such “buy now, pay later”, it is easy to fall prey for transactions

we may not even need in the first place.

Aside from frivolous purchases, debt can come in the form of mortgages for homes and loans from banks to help kickstart a business. Debts can also stem from clients who have a “tab” or from business owners who allow bad business practices to continue.

Tips to Avoid Debt

As a debtor:

● Live within your means. As much as possible avoid using your credit card.

● Pay off debts as soon as possible

● Schedule payments so you don’t miss out on any

As a creditor:

● Do background checks on new potential clients. Check their credit history as this will tell you if they have good standing in terms of their finances.

● Draw up a contract that is legally binding, informing the client of what will happen in case they miss a payment.

● Be vigilant in following up payments.

● Partner up with a reputable debt collection agency to assist you.

Getting the help of a debt collection agency removes the responsibility of following up unpaid invoices from delinquent clients from you. Taking this load off of your chest allows you to focus on other important matters regarding your business.

The Debt Collection Process

Debt collection isn’t about knocking on someone’s door and demanding that they pay up. There are nuances and guidelines that a reputable debt collection agency follows, one that is

mandated by law.

The Australian Competition and Consumer Commission (ACCC) and Australian Securities and Investment Commission (ASIC) have collectively made up guidelines that collectors and

creditors must comply with for smooth transactions:

- Commonwealth consumer protection laws

- Practical guidance on what creditors and collectors should and should not do to minimise their risk of breaching the Commonwealth consumer protection laws

- Penalties that apply for contraventions of the Commonwealth consumer protection laws

- Other laws and regulations that are not enforced by the ACCC and ASIC, but which are relevant to debt collection.

What An Agency Does

We at JMA Credit Control often get inquiries from business owners who are concerned about the growing number of debtors and their subsequent debts. When we take on a client, we inform

them of our “no collection, no fee” policy – simply put, we won’t be paid for our services until the debt has been duly collected. This is a risk-free setup for our clients.

Here is a general flow of how we conduct debt collection:

Getting as much information as we can about the debtor and the debt

Sometimes people aren’t even aware of the fact that they have debt until an agency contacts them. This could happen when the information they gave the creditor is not updated. Another reason why we need to know as much as we can about the debtor is so we can determine whether the debt falls within the creditor’s legal right to ask for it. In Australia debts can be “written off” after a certain period of time. These debts are called “statute-barred debts”.

Making contact with the debtor

A debt collection agency may get in touch with the debtor through a simple phone call or letter. We let them know that we are collecting on behalf of the creditor. If after this initial contact the debtor still refuses or has not paid, then we send a debt collection letter. If the debtor can’t be contacted initially, it needs to be followed up with an email, phone call, or letter.

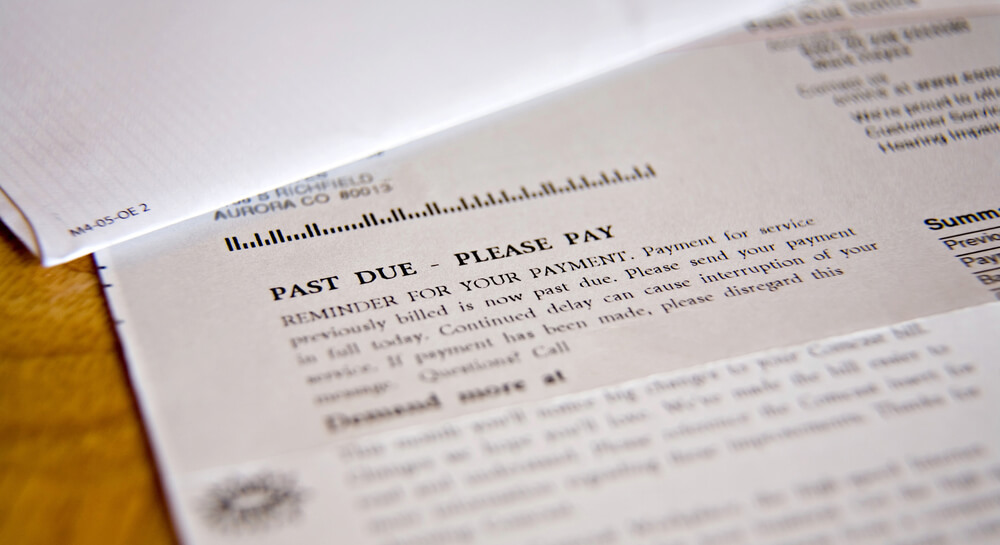

Sending a debt collection letter

This will act as a final notice to the debtor of their debt and they need to pay within a certain number of days (usually it’s 14 days) or at least reach out to us so this matter can be discussed further. Most of the time, people are jolted to finish their debt when they receive a debt collection letter because failure to do so may mean that things will have to be settled in court.

Issue of complaint

When contacting the debtor fails, or they have refused to pay the debt, the creditor may opt to bring the matter to court. If this happens, working with a debt collection agency is a wise choice since we have in-house lawyers who can study the case further.

Take note that heading to court isn’t always the best choice; as much as possible it is always better to settle things with the debtor. Filing a “complaint” in legal terms means that the filing party (creditor) has sufficient and strong evidence against the defendant (debtor) that it entitles a remedy or damages to be paid. (The State of Victoria has jurisdiction to deal with debt recovery claims and damages claims amounting to up to $100,000 only.)

Service of Complaint

This is when the Complaint is legally recognised. A hard copy of the Complaint is sent to both the filing party and defendant (debtor). Aside from the Service of Complaint, the debtor also receives a Notice of Defence, allowing them to defend or dispute any claims made against them. If the debtor fails to respond to the Service of Complaint, they will need to pay the debt. The court will rule in your favour.

Payment Arrangements

Given the circumstances, the debtor may propose a payment arrangement that he or she can follow and the judge generally agrees to this. Failure to comply with this new payment scheme means that we, the debt collection agency, may resort to other options such as a warrant to seize assets, issuance of bankruptcy notice, warrant of seizure & sale to sell real estate, or petition.

How Long Will the Process Take?

It is difficult to say how long the process will take as it will depend on the debtor’s capabilities (or lack thereof) of paying off their debt. Sometimes after the initial phone call or letter is enough,

while other cases may take years before the debt is collected. Rest assured that as long as it is within the creditor’s legal right to collect a debt, we will be there every step of the way.

When a Debt Collection Agency Contacts You: What To Do

It can be unnerving to be contacted by a collecting agency when you are unaware of any debts. When this happens, ask for more details regarding the debt. If you are still unsure, don’t hesitate to inform them that you would like to seek legal counsel first.

The Takeaway

Debts are never easy on both the creditor and debtor. These guidelines are meant to protect both parties; failure to comply on your end may mean that you might be forced to have the debt written off. It is important to enlist the assistance of a reputable debt collection agency that has the experience to handle such cases.