Most of the time, transactions with clients go off without a hitch. Happy days!

But what happens when you encounter those special few who try to weasel their way out of a payment with some less-than-clever excuses?

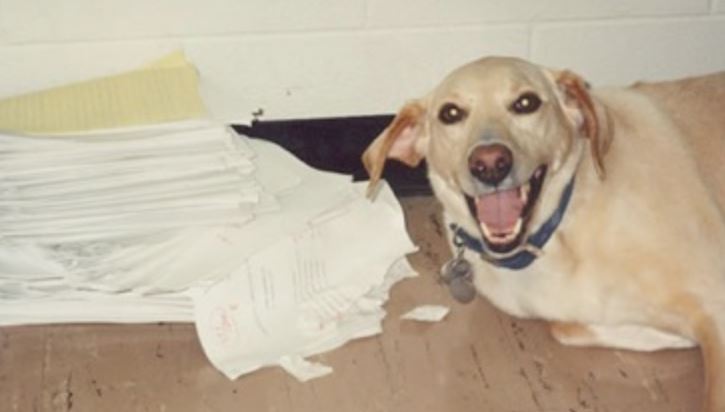

Popular examples include, “it got lost in the mail!”, or even the oh-so cliched and ridiculous “my dog ate the invoice!”

Well, it’s important to retain a professional and business-focused mindset when dealing with all kinds of clients – even in these sorts of instances.

When it comes to retrieving your lost cash from an uncooperative client, you might feel like you’ve come up against a brick wall. But it’s not impossible.

To assist you, listed below are seven excuses that have been used by real clients to get out of paying invoices, and our suggestions on how to handle each:

1. “You didn’t do a good enough job, so I won’t pay”

Some debt collectors notice that clients try to avoid paying invoices by citing dissatisfaction with the offerings concerned. Customer dissatisfaction is something that you will come up against, whether you’re providing goods or services. So, knowing how to handle these instances is vital.

For example, if you’re building something for a customer, you will likely have a clause in your contract about the client’s satisfaction at the time of completion of the job. It’s important to have open and honest communication with clients about their satisfaction to help to avoid these sorts of situations from occurring.

If a customer is dissatisfied with your work, you can work with them to find out exactly what is wrong and whether that issue can be rectified. But ensure you make it clear that if you are rectifying their concerns, payment is still expected.

If you still have not reached an agreement, remind the client of the conditions they agreed to, and prove that you have fulfilled all contractual duties. Then request payment once more. Keep a record of all conversations, written or recorded, as they are necessary if the situation escalates.

2. “I emptied my wallet over the holidays”

During the holidays, especially around the Christmas season, get ready to hear clients using their personal finances as an excuse for not paying their invoices. While the holiday season can be a trying time financially for people, it can compromise your position if people are not paying you either.

To combat this excuse, you could consider offering an installment plan as a compromise. This way, your client can financially recover, and you can recollect the debt, even if it is not as timely as you would have initially liked.

3. “I did not receive your invoice “

This is a simple excuse that is tried over and over again. Once upon a time this one could work quite well – back when there really was only one way to invoice people – through snail mail. But these days, there are lots of different ways to get in touch with people.

Many of us use emails as a way to invoice clients and customers, as we tend to have people from all over the country and world using our goods and services. So, if you do email invoices, a simple step you could take initially, is by turning on the ‘read receipt’ features to ensure that you can see when an invoice has been viewed and follow up with your client frequently regarding payment dates through digital letters, automated phone calls, or emails.

Call your client and offer to send them another copy of the invoice in question. Stay on call and prompt the client to verbally confirm that they have received it.

After having done so, settle on a new payment date. Let them know that if you do not receive payment by then, you will involve a professional debt collector.

4. “We are in the process of switching banks.”

Do not be fooled by this excuse: the process of changing banks really doesn’t take too long these days.

To be fair, it may be a little disruptive for the person or business in question, however, once you alert them to their unpaid invoice, if it was simply lost in the process of the changeover, then they should pay it relatively quickly.

You could also ask for an alternative payment method such as Paypal or credit card, if there are no other payment options. Or, you can offer a new payment date for their invoice.

5. “I dropped my phone in the ocean so it isn’t reasonable that I should pay for a phone bill.”

These situations may only affect certain businesses and industries, however, if you find yourself in this situation, they do require a professional mindset and patience.

Remind the client that they still have a contractual obligation to fulfill the requirements of the payment contract and that the incident does not nullify it. Remain calm, patient, and try to avoid escalating the situation.

6. “Our company is/was under the process of liquidation”

First, verify the factuality of the statement through public websites such as ASIC, which show the liquidation status of companies, or through other businesses that are associated with your client’s company.

If your client’s company is not, in fact, under liquidation, let your client know that you have verified their statement as false, and request for payment again. If their company is under financial trouble, payment plans such as a payment installment plan could be implemented.

In the case that the company is truly under the process of liquidation, request for a proof of debt claim from the company’s liquidators. This will allow you to alert the liquidators of outstanding debts owed to you, which may lead to you having your debts recovered in the liquidation process.

7. “My pet ate my invoice”

If you somehow encounter this comical excuse, remember to remain calm, retain that professional and business-like mindset.

Remind the client that issuing another invoice is easy.

State a new, final payment date, and let them know your willingness to involve a professional debt collector, should the client not pay the debt by then.

What else can I do to recover my unpaid debts?

If none of the above-stated steps resulted in a positive outcome, suffice to say, you may need the services of a professional debt collection agency. Their involvement may result in faster payment, and a sense of urgency on the client’s part, to fulfill their contractual obligations.

JMA Credit Control’s team of professional debt collectors have seen and heard it all: from unbelievable excuses to reasons that are way beyond our control. With over decades of experience under their belt, it’s not surprising why small business owners choose JMA Credit over other debt collection agencies.

We can work with you to recover your unpaid debts, all while keeping your professional integrity intact. We pride ourselves on our high success rate and we want to work with you to make it a little easier to run your business today.

You can get in touch with us by calling us on 1300 664 223. Let JMA Credit Control help you today.