Are you at your wit’s end when it comes to overdue invoices? Have you grown sick and tired of clients who don’t pay on time?

Charging late fees is a common practice that helps businesses and clients alike, and if you’re unsure of how to go about doing this from this day forward, we have some helpful tips that can make changes within your business run more smoothly.

Terms and Conditions

First of all, do you have a Terms and Conditions document in place? If not, then now is the time to seriously consider making one.

A Terms and Conditions document is a legally binding contract between yourself and your client. It explains and lists down details of your transaction and includes the following:

- Goods and services offered/available

- Payment terms

- Privacy policy

- Returns and refund policy

- Penalty and late fees

To ensure the effectiveness of your terms and conditions, make them as simple as possible; avoid using jargon or terms that your client might not be familiar with. When you present this contract, make sure that the client understands everything that’s written as this can be used in the court of law if the need arises. You can learn more about it here.

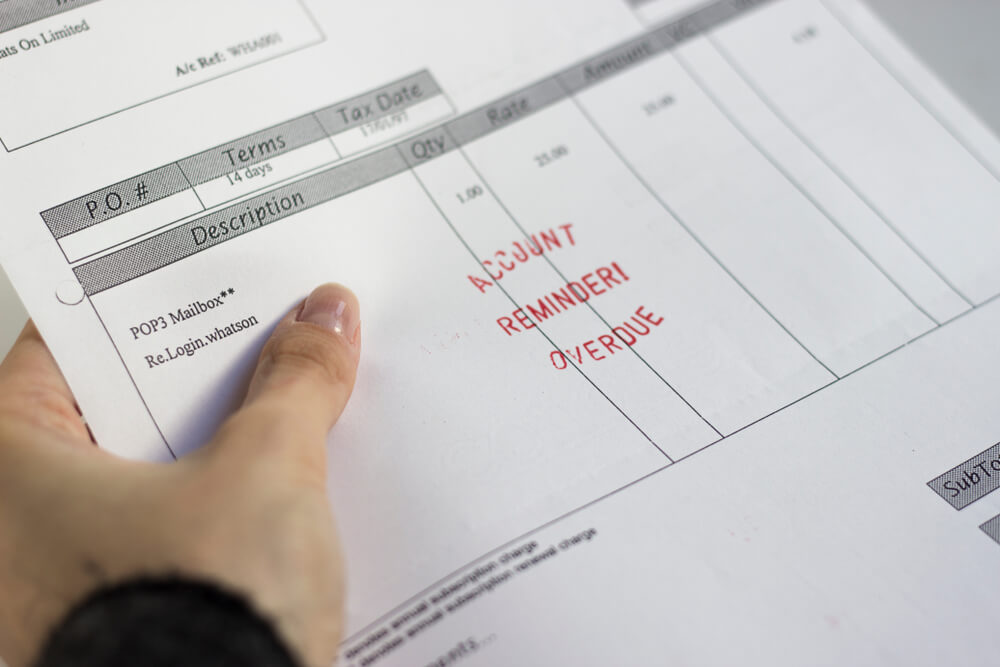

Double Check Your Accounts Receivables Process

How do you remind clients to pay on time? Do you have a process that is efficient and effective? Setting up an accounts receivable process helps you keep track of your finances. Including late fees in your terms and conditions encourages clients to pay their invoice early or on the dot and prevents you from paying expenses out of pocket.

Before you run after errant clients or hire a professional debt collector, check how you manage your accounts receivables first. See if there are ways that you can improve it.

Make Sure Your T&Cs Has Been Clearly Understood

As we have mentioned earlier, your terms and conditions is a legally binding agreement between yourself and your client. Everything here should be explained in detail. Always ask the client if they have any questions or concerns.

Oftentimes business deals become awry either because terms and conditions aren’t clearly written, or the client has failed to understand what exactly his obligations are. Your payment options, due dates, and other such information should be communicated in an easily understood manner.

Don’t Wait to Send Out Invoices

When a customer has confirmed their order, waiting to send out invoices won’t work for you. The moment they have agreed to do business with you, immediately send an invoice. One of the reasons why you should send them out immediately is if you offer net-14 or net-30 days payment terms, the day they receive the invoice will be counted as day 1 of the time frame.

Your client might be running a business too or may have a job. Waiting to send out an invoice will be a bit of a surprise for them as they may have moved on to other tasks.

Sit Down and Review Accounts

Take some time to review current accounts and identify which ones have been consistently paying late. These types of clients need to be warned and be made aware that you know of their late payments.

Saying something like,

“After reviewing accounts, I noticed that you have paid the last 3 invoices an average of 10 days late. I just want to make sure that this upcoming one will be paid on XXXX.”

This type of verbal warning can work wonders as it reminds the client that you’re not out of the loop and very much in touch with how things are going.

Remind, Remind, Remind

Regular reminders of their upcoming payment dues will encourage clients to pay on time to avoid any late penalty fees. You may set up a scheduled email reminder to help manage things better on your end.

Contact a Professional Debt Collector

A debt collection agency is your best partner in helping improve cash flow and lessen debts owed to you. Have your Terms and Conditions reviewed by a professional to make sure that everything is within legal and constitutional limits.

Every once in a while, you will encounter a client or two who completely forego their obligations as a customer. Lessen the stress and burden of running after them by getting in touch with a debt collection agency. JMA Credit Control has over 50 years of collective experience in the industry. Our team of debt collectors handle each and every case with care. Contact us now and find out how we can be an asset to your business.