If you find yourself reading this, chances are that you’re after some help to collect outstanding debts that your business is owed.

Whether these unpaid debts are from delinquent individuals or other businesses, finding the time to effectively recover this money is exactly what you do not need right now.

The best way to easily recover the debts you are owed is through the use of an experienced debt collection service.

Why?

Well, debt collection agencies have the skills, knowledge and resources that allow them to effectively recover unpaid invoices and debts. And realistically, debt collection is their business too – so effective and efficient recovery of your debts is in their best interest.

While the idea of recovering these funds is obviously very appealing to you – especially if you’ve been trying to collect this money for some time, you’re probably asking yourself an important question – how much is debt recovery really going to cost you?

Well, today we’re going to provide you with some handy information about how much debt collection services can cost, as well as some tips on what to look for in a debt collection agency, and also, how much outstanding debts can end up costing your business.

So, keep reading to learn more about the cost of debt recovery.

Debt Recovery Costs – We answer your questions

Now, while we may not be able to tell you how much it’s going to cost to recover your outstanding debt you have right now, we can give you some guidance, so here goes.

How much will it cost to recover my debt?

Costs of debt recovery services do differ from debt collection service to debt collection service. There is a myriad of factors that can influence the cost of a debt collection service, some of the most common being:

- The size of the debt

- If it’s a once-off recovery or part of an ongoing membership with the debt collection service

- Whether you’re working with a debt recovery agency or a debt recovery lawyer.

In most instances, when you choose to work with a debt collection agency, they will charge you for their services based on a percentage of the debt recovered. The smaller the debt that they are recovering the standard industry practice is to charge a higher percentage collection rate.

If you choose to use a debt recovery lawyer, you will likely have to pay an hourly rate for their services, which can be anywhere between $150-$450 an hour, depending on their experience.

What does No Recovery, No Fee mean, and is that good?

A “No Recovery, No Fee” policy basically means that if the debt collection agency cannot recover your debt for you, you won’t need to pay anything.

When you work with a debt collection agency that offers this, you will register your debt with them, provide any required information, and not pay a thing, until your debt is recovered.

If you’ve joined the debt collection service on a membership basis – which we will explain more about shortly – you will still be paying your membership fees. However, you won’t be paying any collection fees for that debt, unless it recovered.

Every debt collection agency worth their weight in gold will have a “No Recovery, No Fee” policy in place.

So, you can have a membership to a debt collection agency?

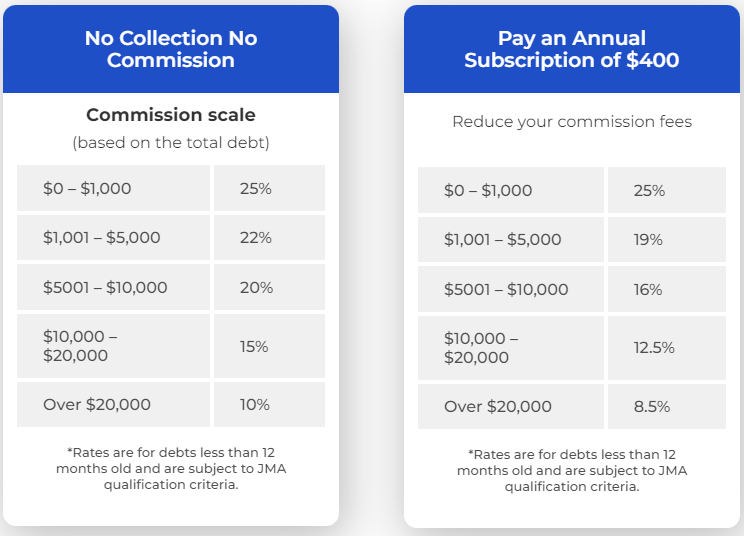

Yes. This may be referred to as a membership or subscription to the agency’s services and it essentially entails your business paying an annual fee to use the services for the next 12 months. While you pay an annual fee for the service, for all debts recovered, the commission fee you pay is less than if you choose the one-off debt collection option.

This type of arrangement is particularly useful for businesses with a large client base or those that have experienced issues with debt recovery before. A debt collection service doesn’t need to be your last resort as a business owner, you can engage their services relatively early in your debt recovery journey.

What is the minimum size of debt that a debt collector can recover?

While it will differ from agency to agency, usually debt recovery services can be used to collect debts valued at $1000 or more. Some agencies may require a higher minimum debt to engage their services. Some may allow a smaller amount, usually when you’re a member of their service.

At JMA, for once off debt collection services, we require the debt to be a minimum of $1000.

What does JMA charge for their debt collection services?

Here at JMA, we offer once off debt collection services, along with a no recovery no fee policy. We also offer businesses the option to subscribe to our services for an annual fee.

At the time of writing this article (Updated January 2023), we offer a sliding scale commission fee. The higher the value of your debt, the less the percentage of your debt, the commission is. For customers who choose to sign up to our annual subscription service, the commission percentage is lower than those who don’t. You can see the current debt recovery collection fees below:

These costs are correct as of January 2023 – for the most current up to date information on our rates, click here.

As you can see, we work hard to ensure our services are worth engaging for your business. We know that having unpaid debts can be debilitating to your business, which is why we want to make to possible and viable for you to engage our services and have those debts recovered.

Why should I be using a debt collection service?

While you’re trying to work out how much a debt recovery service might end up costing you, something to keep in mind is how much it might end up costing you if you don’t use one.

If it’s the first time you have had a delinquent customer or the debt is quite small, using a debt collector might not be the right option for you.

However, if you’ve experienced numerous unpaid client invoices and you have team members having to spend countless hours on trying to chase up customers, that’s valuable time being wasted – especially if the debts are not being recovered successfully.

Outstanding debts that your business is owed can have a huge impact on the livelihood of your business. It can impact cash flow, it can mean that people on your team are spending more time on chasing up old customers than they are on finding and helping new ones, and it can lead to a whole host of head aches for your business.

Even if you’re not sure if debt collection is the right option for you, you can always talk to our team at JMA. We can help you understand how we can help and the benefits we can provide. And with a No Recovery No Fee policy in place – what do you have to lose?

Why Choose JMA for Debt collection services in Australia?

If you have a small to medium sized business, JMA should be your first choice for your debt recovery needs.

Our team is comprised of an experienced professional debt recovery experts. We pride ourselves on providing fair prices and excellent service. Our 50+ years of experience has allowed us to hone our recovery techniques and it’s safe to say we have it down to an art.

If you have debts that need to be recovered for your small to medium sized business in Australia, give us a call today. We have offices in Melbourne, Sydney and Brisbane, and provide our debt collection services nationally.